how to calculate sales tax in oklahoma

20 on the first 1500 plus 325 percent on the remainder. Oklahoma all you need is the simple calculator given above.

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

. Oklahoma also has a vehicle excise tax as follows. Other local-level tax rates in the state of Oklahoma are. A customer living in Edmond Oklahoma finds Steves eBay page and purchases a 350 pair of headphones.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 771 in Oklahoma. Average Local State Sales Tax.

Enter the Amount you want to enquire about. Oklahoma City has parts of it located within. Your average tax rate is 1198 and your marginal.

Find your Oklahoma combined. The state sales tax rate in Oklahoma is 450. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

This includes the rates on the state county city and special levels. The calculator will show you the total sales tax amount as well as the. Free online 2020 Q2 reverse sales tax calculator for 73121 Oklahoma City.

Since this varies by city and county use the state sales tax rate of 45 045 plus the applicable city andor county rates. Income tax 05 - 5. States have the right to impose their own taxes on residents and non-residents.

If you do not. The average cumulative sales tax rate in Oklahoma City Oklahoma is 867. The Oklahoma OK state sales tax rate is currently 45.

In Oklahoma this will always be 325. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. However in addition to that rate Oklahoma has.

Maximum Local Sales Tax. In Oklahoma this will always be 325. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to.

You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code. When calculating the sales tax for this purchase Steve applies the. You are able to use our Oklahoma State Tax Calculator to calculate your total tax costs in the tax year 202223.

Our calculator has recently been updated to include both the latest Federal Tax. Oklahoma Income Tax Calculator 2021. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. To know what the current sales tax rate applies in your state ie. Sales Tax Table For Oklahoma.

Depending on local municipalities the total tax rate can be as high as 115. Tulsa has parts of it located within Creek County Osage. Maximum Possible Sales Tax.

This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Tulsa Oklahoma is 831. Oklahoma Sales Tax.

Use tax is calculated at the same rate as sales tax. Multiply the vehicle price by the sales. 325 percent of the purchase price.

Oklahoma State Sales Tax. The Oklahoma state sales tax rate is 45. Fast and easy 2020 Q2 sales tax tool for businesses and people from 73121 Oklahoma City United States.

Alone that would be the 14th-lowest rate in the country. The base state sales tax rate in Oklahoma is 45. Multiply the vehicle price after trade-ins and incentives.

All numbers are rounded in the.

Beginner S Guide To Dropshipping Sales Tax Printful

Etsy Marketplace Collects Sales Tax For You Accounting For Jewelers

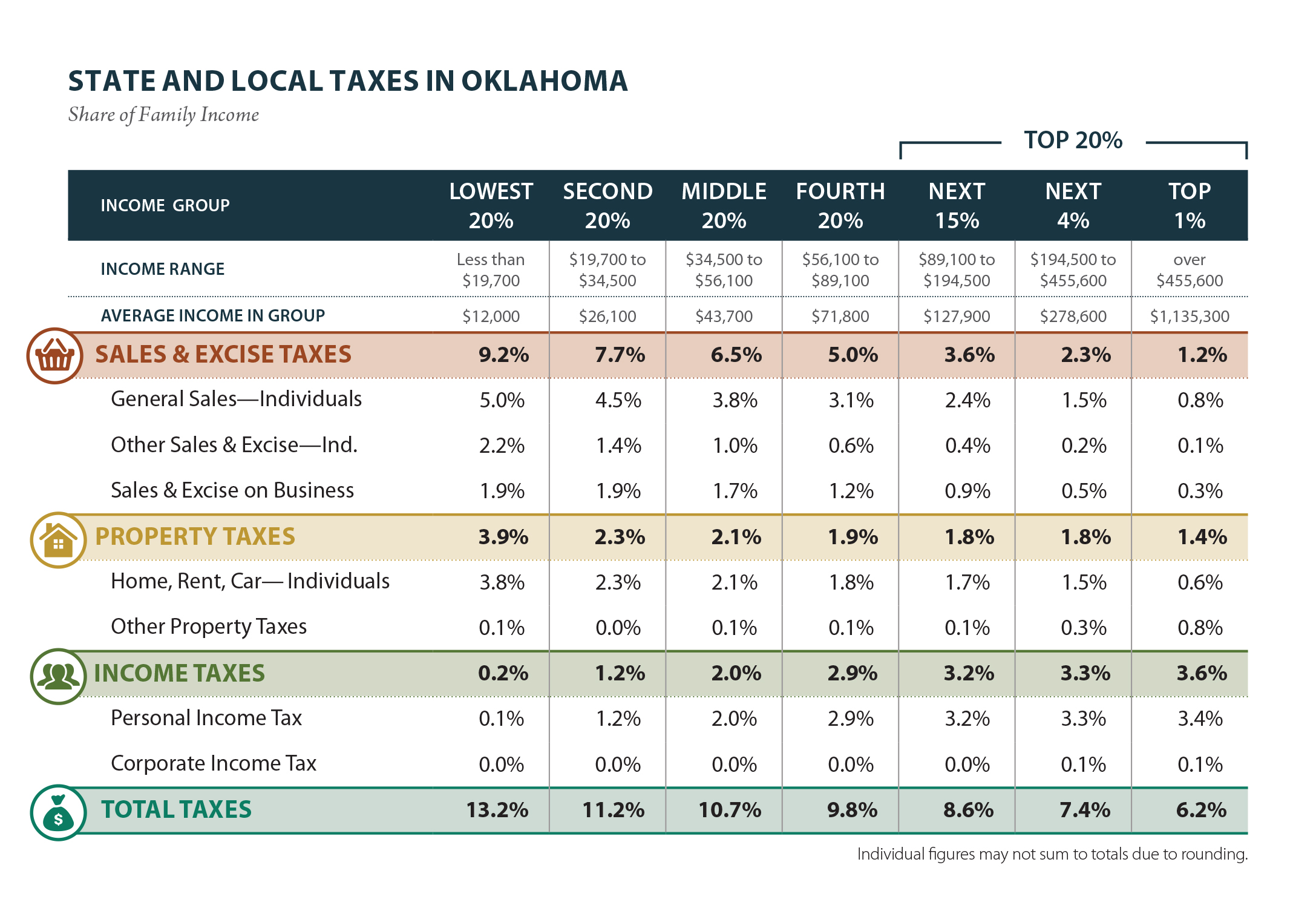

Oklahoma Who Pays 6th Edition Itep

State Sales Tax Rates Sales Tax Institute

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Saas Sales Tax For The Us A Complete Breakdown

Sales Tax Calculator Credit Karma

Oklahoma Tax Commission We Re Going Backtothebasics With Okcars Okcars Is A Convenient Online Resource Used Anywhere Anytime To Quickly Renew Vehicle Registration Order Specialty License Plates And Calculate New Vehicle Sales

Consumers Behavioral Response To Sales Taxes On Food In Kansas Document Gale Academic Onefile

Sales Tax Calculator And Rate Lookup Tool Avalara

Online Sales Tax In 2022 For Ecommerce Businesses By State

How To Charge Sales Tax In The Us A Simple Guide For 2022

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Oklahoma Who Pays 6th Edition Itep

Oklahoma Income Tax Calculator Smartasset

Cherokee Chief Says No Oklahoma Income Tax For Indians Oklahoma Council Of Public Affairs